Issue No.: 01

While posting a transaction through transaction code ABSO- Miscellaneous Transaction, the system returns an error message. After further analysis, the user finds that his company code is activated for parallel currencies. How can the user set up depreciation areas for parallel currencies?

If your company code is set up for multiple currencies and has implemented asset management, then be sure you are complying with the following steps:

1. Verify how many currencies are active for your company code. You can verify this setting in transaction code:__(menu path: IMG → Financial Acctg → Financial Acctg Global Settings → Company Code → Multiple Currencies → Define additional local currencies).

2. Review your depreciation areas in AA. In case of multiple currency scenarios, you should have one additional depreciation area for each currency. You can check this setting in transaction code OADB (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Depreciation Areas → Define Depreciation Areas).

3. For each additional depreciation area, define the depreciation transfer rule with transaction code OABC (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Depreciation Areas → Specify Transfer of Depreciation Terms). You must set up the transfer values for additional depreciation areas from book depreciation area 01.

4. Similar to step 3, you have to set up the APC transfer rule. You can set up this transfer rule through transaction code OABD (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Depreciation Areas → Specify Transfer of APC Values).

5. Now you can set up currency for additional depreciation areas through transaction code OAYH (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Currencies → Define Depreciation Areas for Foreign Currencies).

While posting a transaction through transaction code ABSO- Miscellaneous Transaction, the system returns an error message. After further analysis, the user finds that his company code is activated for parallel currencies. How can the user set up depreciation areas for parallel currencies?

If your company code is set up for multiple currencies and has implemented asset management, then be sure you are complying with the following steps:

1. Verify how many currencies are active for your company code. You can verify this setting in transaction code:__(menu path: IMG → Financial Acctg → Financial Acctg Global Settings → Company Code → Multiple Currencies → Define additional local currencies).

2. Review your depreciation areas in AA. In case of multiple currency scenarios, you should have one additional depreciation area for each currency. You can check this setting in transaction code OADB (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Depreciation Areas → Define Depreciation Areas).

3. For each additional depreciation area, define the depreciation transfer rule with transaction code OABC (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Depreciation Areas → Specify Transfer of Depreciation Terms). You must set up the transfer values for additional depreciation areas from book depreciation area 01.

4. Similar to step 3, you have to set up the APC transfer rule. You can set up this transfer rule through transaction code OABD (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Depreciation Areas → Specify Transfer of APC Values).

5. Now you can set up currency for additional depreciation areas through transaction code OAYH (menu path: IMG → Financial Acctg → Asset Accounting → Valuation → Currencies → Define Depreciation Areas for Foreign Currencies).

Issue No.: 02

The user posts an acquisition transaction through transaction code F-90 and expects the capitalization and depreciation start date to be filled by the system. SAP help says the capitalization date and depreciation start date will be filled by the system with the first acquisition date. But this is not happening in his case. How can this be resolved?

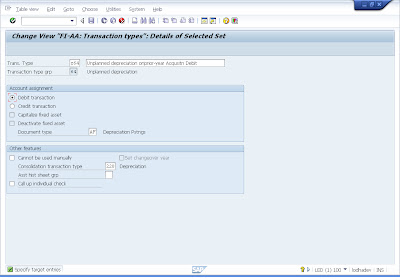

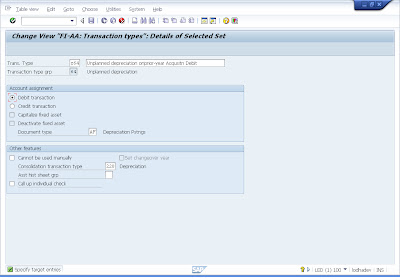

As per SAP standard practice, on the first acquisition, the system will populate capitalization and the first depreciation date. If this is not happening, check your configuration setting in transaction code AO73 (menu path: IMG → Financial Accounting → Asset Accounting → Transactions → Acquisitions → Define Transaction Types for Acquisitions → Define Transaction Types for Acquisitions).

In the screen that appears, shown in Figure check whether the Capitalize fixed asset box is checked. If not, check it.

Issue No.: 03

A user needs help with the following situation:

Some assets will be purchased for $50 million. Then, after using them for 12 years, they can be sold for $5 million. So, the depreciable basis needs to be $45 million instead of $50 million over 12 years, or $3.750 million per year. The method will be straight line. So at the end of the 12 years, the net book value should be $5 million.

A user needs help with the following situation:

Some assets will be purchased for $50 million. Then, after using them for 12 years, they can be sold for $5 million. So, the depreciable basis needs to be $45 million instead of $50 million over 12 years, or $3.750 million per year. The method will be straight line. So at the end of the 12 years, the net book value should be $5 million.

The SAP R/3 system comes with two options to handle the scrap: (1) by defining an absolute percentage or (2) by entering an absolute value.

1. You can define an absolute percentage in the scrap key and then assign the key to the asset master. To define the scrap key, use transaction code ANHAL (menu path: IMG → Financial Accounting → Asset Accounting →Depreciation → Valuation Methods → Further Settings → Define the Cutoff Value Key).

Using transaction code ANHAL

2. Instead of a scrap key, you can enter an absolute amount in the asset master as a scrap value.

Depending upon your other configurations, either the scrap value will be reduced before calculation of depreciation or the system will limit depreciation to the scrap value.

2. Instead of a scrap key, you can enter an absolute amount in the asset master as a scrap value.

Depending upon your other configurations, either the scrap value will be reduced before calculation of depreciation or the system will limit depreciation to the scrap value.

Issue No.: 04

When the user is processing asset impairment through transaction code ABMR, the system pops up with the Depreciation Areas screen. The user does not want this pop-up screen. Is there any way of turning off this popup and defaulting to the appropriate areas?

When the user is processing asset impairment through transaction code ABMR, the system pops up with the Depreciation Areas screen. The user does not want this pop-up screen. Is there any way of turning off this popup and defaulting to the appropriate areas?

Additional settings for period control OAVH

It is ideally advisable not to change this configuration. This pop-up window lets you select your desired depreciation areas for asset impairment. If you want to avoid this, you have to change the configuration through transaction code OA81. In this transaction code, you are setting automatic posting.

It is ideally advisable not to change this configuration. This pop-up window lets you select your desired depreciation areas for asset impairment. If you want to avoid this, you have to change the configuration through transaction code OA81. In this transaction code, you are setting automatic posting.

Issue No.: 05

How can the user change the screen layout for equipment masters in order to add warranty information?

If you are trying to put the warranty information on the equipment master data record itself, you can configure this in the IMG within the PM module.

Follow the menu path: IMG → Plant Maintenance and Customer Service → Master Data in Plant Maintenance and Customer Service → Technical Objects → General Data → Set View Profiles for Technical Objects.

The transaction code for Set View Profiles for Technical Objects controls various field layouts of the equipment master.

Issue No.: 06

When the user is processing asset impairment through transaction code ABMR, the system pops up with the Depreciation Areas screen. The user does not want this pop-up screen. Is there any way of turning off this popup and defaulting to the appropriate areas?

When the user is processing asset impairment through transaction code ABMR, the system pops up with the Depreciation Areas screen. The user does not want this pop-up screen. Is there any way of turning off this popup and defaulting to the appropriate areas?

Additional settings for period control OAVH

It is ideally advisable not to change this configuration. This pop-up window lets you select your desired depreciation areas for asset impairment. If you want to avoid this, you have to change the configuration through transaction code OA81. In this transaction code, you are setting automatic posting.

It is ideally advisable not to change this configuration. This pop-up window lets you select your desired depreciation areas for asset impairment. If you want to avoid this, you have to change the configuration through transaction code OA81. In this transaction code, you are setting automatic posting.

Issue No.: 07

The user is configuring the depreciation key. He has a unique requirement for calculating depreciation for the month of acquisition as well as retirement. Here is the requirement:If the asset is purchased from the 1st to the 15th of a month, the depreciation should be calculated for the full month. If the assets are purchased after the 15th of a month, then no depreciation for the month of purchase is calculated. However, depreciation should be calculated for the full month for subsequent months.

The user is configuring the depreciation key. He has a unique requirement for calculating depreciation for the month of acquisition as well as retirement. Here is the requirement:If the asset is purchased from the 1st to the 15th of a month, the depreciation should be calculated for the full month. If the assets are purchased after the 15th of a month, then no depreciation for the month of purchase is calculated. However, depreciation should be calculated for the full month for subsequent months.

The start date and end date of depreciation are controlled through the period control method. You are assigning a calendar here to control how depreciation will be calculated for the acquisition month.

See your configuration by using transaction code OAVH (menu path: IMG → Financial Accounting → Asset Accounting → Depreciation → Valuation Methods → Period Control → Define Calendar Assignments).

Issue No.: 08

In January 2008, a user noticed that assets purchased in 2007 were not recorded in the books of account. In the meantime, the user closed the books of account for 2007. Now the user wants to disclose this asset in his books of account from January 2008.

This issue can be handled in two different ways, depending upon user requirements, i.e., from which date the user wants to calculate depreciation expenses.

1. If the user wants to calculate depreciation from January 2008, then post the asset acquisition using transaction code F-90 with reference to a vendor or using transaction code F-91 through a clearing account.

2. If the user wants to charge depreciation starting from the original purchase date, then post the acquisition through transaction code ABNAN. Then enter that date, 07/01/2007 in this example, in the Orig. val.dat field as shown in

Figure Using transaction code ABNAN

Issue No.: 09

The user wants to attach JPG pictures of assets to the asset master record. How can he do this?

The user wants to attach JPG pictures of assets to the asset master record. How can he do this?

You can attach JPG pictures to an asset master. From the asset master record menu, choose System → Services for Object → Create Attachment.

Issue No.: 10

The user acquired his first set of assets in the month of February 2008 and is trying to run depreciation starting from February. While running depreciation, the system returns the following message: "According to the posting cycle, you should post period 001 next. Either enter period 001, which corresponds to the posting cycle, or request an unplanned posting run explicitly for this parameter."

The user acquired his first set of assets in the month of February 2008 and is trying to run depreciation starting from February. While running depreciation, the system returns the following message: "According to the posting cycle, you should post period 001 next. Either enter period 001, which corresponds to the posting cycle, or request an unplanned posting run explicitly for this parameter."

If your posting cycle is monthly, then your SAP solution expects depreciation to run for every period in sequential order. So, you can't run February until you have completed the January depreciation run. Since you have acquired assets in the month of February, you are not running depreciation for the month of January. However, SAP R/3 is expecting you to run depreciation for January also. To overcome this, you have to do one of the following:

(1) run depreciation for the month of January and then the month of February or

(2) select the unplanned posting run for February. The unplanned run lets you skip over periods (in instances like this).

Issue No.: 11

Assume the following scenario in AA:

Life of the asset: 3 years

Original Cost: 60,000; Scrap Value: 15,000.

The configuration was done in such a way that the SAP solution was taking the original cost as the basis for calculating depreciation. Thus, it is calculating depreciation as follows:

1st Year: 20,000

2nd Year: 20,000

3rd Year: 5,000

However, the user requirement is that depreciation should be calculated based on original cost net of scrap value. That is, depreciation should be as follows:

1st Year: 15,000

2nd Year: 15,000

3rd Year: 15,000

Assume the following scenario in AA:

Life of the asset: 3 years

Original Cost: 60,000; Scrap Value: 15,000.

The configuration was done in such a way that the SAP solution was taking the original cost as the basis for calculating depreciation. Thus, it is calculating depreciation as follows:

1st Year: 20,000

2nd Year: 20,000

3rd Year: 5,000

However, the user requirement is that depreciation should be calculated based on original cost net of scrap value. That is, depreciation should be as follows:

1st Year: 15,000

2nd Year: 15,000

3rd Year: 15,000

This could be achieved by using T-code AFAMA in SPRO by resetting (for each depreciation key) the scrap value field as "Base Value is reduced by the Scrap Value Amount."

Issue No.: 12

Suppose that during year end, the period for both March and April are open and the depreciation run for April is also executed. The asset year closing for the previous year is not done. Now an adjustment in depreciation is to be made in the previous year (for the March period) and the user has to run depreciation once again for March. Is this possible?

Suppose that during year end, the period for both March and April are open and the depreciation run for April is also executed. The asset year closing for the previous year is not done. Now an adjustment in depreciation is to be made in the previous year (for the March period) and the user has to run depreciation once again for March. Is this possible?

Run a depreciation recalculation (transaction code AFAR) before you execute another depreciation run.

Issue No.: 13

The user is trying to create an asset master using transaction code AS01. He is able to see fields in the General, Time dependent, and Allocations tabs, but is not finding fields in the Depreciation Area tab. As a result, the user is unable to specify the depreciation key and life of an asset.

The user is trying to create an asset master using transaction code AS01. He is able to see fields in the General, Time dependent, and Allocations tabs, but is not finding fields in the Depreciation Area tab. As a result, the user is unable to specify the depreciation key and life of an asset.

1. Check your screen layout for depreciation areas (transaction code AO21).

2. In T-code OAYZ, make sure that the depreciation areas are activated and a depreciation key is assigned. Also, check the screen layout rule for the depreciation area. It is the last column in the table after useful life and index. This is where you enter the depreciation screen layout.

Issue No.: 14

When you retire an asset, you only want the depreciation that has been posted to be reversed, i.e., accumulated depreciation up to the last month has to be reversed. However, the system is also taking the current month's unplanned depreciation into consideration when reversing accumulated depreciation and hence the profit and loss is calculated incorrectly. How can this be changed?

You assign the period control method in the depreciation key. The period control method controls how depreciation will be calculated during acquisition, retirement, etc. Check the period control method assigned to your depreciation key, which in turn is assigned to the asset master.

When you retire an asset, you only want the depreciation that has been posted to be reversed, i.e., accumulated depreciation up to the last month has to be reversed. However, the system is also taking the current month's unplanned depreciation into consideration when reversing accumulated depreciation and hence the profit and loss is calculated incorrectly. How can this be changed?

You assign the period control method in the depreciation key. The period control method controls how depreciation will be calculated during acquisition, retirement, etc. Check the period control method assigned to your depreciation key, which in turn is assigned to the asset master.

Issue No.: 15

The user is trying to post unplanned depreciation for an asset for depreciation area 33, i.e., the depreciation area for group currency, using the transaction type 643 and T-code ABAA. While posting, the following message pops up: "In Dep. Area 01, you can post manual depreciation up to the amount 0.00 only." The assets explorer shows the net book value as $1800.

This error generally appears after posting the unplanned depreciation when the net book value of those assets after considering the planned depreciation becomes negative. Depreciation does not allow negative book values.

The user is trying to post unplanned depreciation for an asset for depreciation area 33, i.e., the depreciation area for group currency, using the transaction type 643 and T-code ABAA. While posting, the following message pops up: "In Dep. Area 01, you can post manual depreciation up to the amount 0.00 only." The assets explorer shows the net book value as $1800.

This error generally appears after posting the unplanned depreciation when the net book value of those assets after considering the planned depreciation becomes negative. Depreciation does not allow negative book values.

Issue No.: 16

In AA the client has not closed the year 2005, and so 2006 cannot be closed. For 2005, there are errors and recalculations required for depreciation. However, if this is done, it will hit the FI and figures submitted for 2005will change in the SAP solution. From an audit perspective, this cannot be permitted. How can the user remedy this?

In AA the client has not closed the year 2005, and so 2006 cannot be closed. For 2005, there are errors and recalculations required for depreciation. However, if this is done, it will hit the FI and figures submitted for 2005will change in the SAP solution. From an audit perspective, this cannot be permitted. How can the user remedy this?

The corrections must be made to enable you to close FI-AA for 2005 and carry forward into 2006. If these corrections will significantly change your balance sheet, you can "neutralize" them by posting manual entries to bring your overall balance sheet back to what has already been reported, and then reverse these in 2006. And convince your auditor accordingly.

Issue No.: 17

While creating assets under asset class XXXX, the user is getting default depreciation terms and the system does not allow changing depreciation terms. The user does not want the default depreciation key. How can you resolve this situation?

While creating assets under asset class XXXX, the user is getting default depreciation terms and the system does not allow changing depreciation terms. The user does not want the default depreciation key. How can you resolve this situation?

It sounds as if the depreciation key has been set as the default for the asset class. Check this in the IMG by doing the following:

1. Go to the Depreciation Areas screen layout using T-code OA21. This transaction determines how fields of

depreciation areas in the asset master behave. This transaction code controls whether or not fields are editable.

2. Determine depreciation areas in an asset class using T-code OAYZ. This transaction code determines screen layout of the asset class and depreciation keys assigned to that asset class.

Issue No.: 18

While capitalizing assets, the user capitalized $10,000. During the year-end process, the user realized he has wrongly capitalized $10,000 instead of $7,000. Now the user wants to rectify this by posting a credit transaction through transaction code F-90. While crediting, SAP R/3 returns the following message: "acquisition value negative in the area 15." What does this mean? How can you solve this issue and correctly post the document? Is there any other way to decapitalize an asset?

While capitalizing assets, the user capitalized $10,000. During the year-end process, the user realized he has wrongly capitalized $10,000 instead of $7,000. Now the user wants to rectify this by posting a credit transaction through transaction code F-90. While crediting, SAP R/3 returns the following message: "acquisition value negative in the area 15." What does this mean? How can you solve this issue and correctly post the document? Is there any other way to decapitalize an asset?

To see the negative book value check box, you will have to first activate it in the screen layout. To do this, go to Master Data → Screen layout for Asset depreciation areas, select the screen layout attached to the asset class to which the asset in question belongs, and click on Field group rules. Here you can make negative values optional. If you want to allow the negative book value for all of the assets created in that particular asset class, follow the menu path: Valuation → depreciation areas → Determine depreciation areas in the asset class. Select the asset class, click on the depreciation area, and check the negative book value check box.

If you want to allow negative book values only for a particular asset, you can use transaction code AS02. Go to the Depreciation tab, double-click on depreciation area 15, and then check the negative values allowed check box.

If you want to allow negative book values only for a particular asset, you can use transaction code AS02. Go to the Depreciation tab, double-click on depreciation area 15, and then check the negative values allowed check box.

Issue No.: 19

Is it possible to integrate the sale of assets with the SD module? It will involve some sales tax and also the client wants to generate an invoice in the SAP solution. Can the SD module be used for this?

Is it possible to integrate the sale of assets with the SD module? It will involve some sales tax and also the client wants to generate an invoice in the SAP solution. Can the SD module be used for this?

Follow these steps for selling assets with integration with the SD module:

1. Retire the asset without customer (T-code ABAON). This will credit the APC and debit the clearing account (which is a P&L account).

2. Then take a nonvaluated material for asset sale purpose, and sell the same using SD. Make sure you have a

separate pricing procedure/SD document type, etc., where the account key ERL will post to the clearing account mentioned in step 1. You can collect sales tax/excise, etc., as usual.

Issue No.: 20

After running depreciation posting for a few months, a user found that a few assets were created in the wrong asset class. The user wants to reclassify these assets to the correct asset class.

Or

After running depreciation posting for a few months, a user found that a few assets were created in the wrong asset class. The user wants to reclassify these assets to the correct asset class.

Or

Issue No.: 21

The user wants to move assets to another class because the assets were created under the wrong asset class. The old asset is capitalized on 08/01/2008. Since the depreciation key is 000, there is no depreciation running for that asset. Now the user wants to transfer the asset to another class, so the old asset is removed (or may be retired) with an acquisition date of 08/01/2008, so that the depreciation expenses can be calculated from 08/01/2008.

The user wants to move assets to another class because the assets were created under the wrong asset class. The old asset is capitalized on 08/01/2008. Since the depreciation key is 000, there is no depreciation running for that asset. Now the user wants to transfer the asset to another class, so the old asset is removed (or may be retired) with an acquisition date of 08/01/2008, so that the depreciation expenses can be calculated from 08/01/2008.

This is a case of reclassification of assets. In transaction code ABUMN, = enter the APC and the accumulated cost along with an asset value date of 08/01/2008. In the receiver asset master screen, enter the desired depreciation key and the depreciation start date.

Issue No.: 22

The user wants to post a transaction in the year 2008 through transaction code F-90. While posting the transaction, the system returns the following error: "You cannot post to asset in company code 9999 fiscal year 2008 Message no. AA347."

The user wants to post a transaction in the year 2008 through transaction code F-90. While posting the transaction, the system returns the following error: "You cannot post to asset in company code 9999 fiscal year 2008 Message no. AA347."

Diagnosis:

"A fiscal year change has not yet been performed in Asset accounting for company code 9999."

Procedure:

Check the asset value date.

It looks like the user entered an asset acquisition in fiscal year 2008 for company code 9999, for which the assets accounting (AA) fiscal year change has not been carried out.

For AA, it is required that the user carry out the fiscal year change before entering a transaction in the new year.

Run transaction code AJRW to change the fiscal year. The latest date you can run this transaction code is the last business day of a financial year.

Issue No.: 23

While running the year-end closing process through transaction code AJAB, the system gives the following errors:

While running the year-end closing process through transaction code AJAB, the system gives the following errors:

"Asset is incomplete and has to be completed. Message no. AU083"

Diagnosis:

The asset 000000100001-0000 is marked as incomplete. The asset was created by someone who did not have the ‘asset accountant’ asset view. When this is the case, the system expects that certain required fields are not maintained.

Procedure:

You can add the necessary specifications using the master data change transaction and the needed asset view.

The system gives this type of error when the asset master was not properly maintained. You can execute transaction code AUVA to get the list of incomplete assets. After getting the list of incomplete assets, maintain the necessary data for the asset master and rerun transaction code AFAB.

Issue No.: 24

After the depreciation run, the user changed the capitalized date and the depreciation start date in the asset master. After making changes in the asset master, the user once again ran depreciation in "repeat run" mode. But changes made to the asset master did not hit depreciation, and the difference value is appearing as a planned value when checked in T-code AW01N.

After the depreciation run, the user changed the capitalized date and the depreciation start date in the asset master. After making changes in the asset master, the user once again ran depreciation in "repeat run" mode. But changes made to the asset master did not hit depreciation, and the difference value is appearing as a planned value when checked in T-code AW01N.

If you are making any changes in the asset master that affect depreciation that is already posted, you must follow this procedure:

1. Recalculate depreciation using T-code AFAR.

2. Repeat the depreciation run using T-code AFAB.

Issue No.: 25

The user wants to transfer an asset from one asset class to another asset class. A depreciation expense of the new asset class is assigned to another account determination. The user wants to transfer APC, accumulated depreciation, and depreciation expenses to G/L accounts that are assigned to the new asset class. Transaction code ABUMN has fields for ACP and accumulated depreciation. The user is wondering how depreciation expenses will be transferred from the old accounts to the new account.

The user wants to transfer an asset from one asset class to another asset class. A depreciation expense of the new asset class is assigned to another account determination. The user wants to transfer APC, accumulated depreciation, and depreciation expenses to G/L accounts that are assigned to the new asset class. Transaction code ABUMN has fields for ACP and accumulated depreciation. The user is wondering how depreciation expenses will be transferred from the old accounts to the new account.

Through transaction code ABUMN, you can reclassify assets. In the reclassification process, you can only transfer APC and accumulated costs to a new asset class with immediate effect. Depreciation expenses will be transferred to the new G/L when you run depreciation. However, during the depreciation run, you can't transfer previous depreciation expenses that were already charged to the cost center. But you can transfer current-year depreciation to the new depreciation expenses account. While entering the transaction in transaction code ABUMN, enter in the value date field the date on which you want to transfer your expenses to the new account.

Issue No.: 26

During data migration, the client forgot to transfer two assets whose book values are zero. Now the client wants to bring those assets to the asset portfolio for reporting purposes. The client needs both acquisition cost and accumulated depreciation in FI, including information from the AM module. As the data migration is already done and the company code in question is already in the Go-live stage, how can you bring these two assets to FI— including the Asset module?

The solution for this ticket would be:

1. Set the company code status to "1" Asset data transfer not yet completed.

2. Update legacy data using T-code AS91.

3. Enter the acquisition cost and accumulated depreciation using T-code OASV\

Issue No.: 27

SAP Error Massage KI235, Profit Center was not Updated during Asset Posting. While i am posting asset with F-90 the cost center and PCA field s are coming in Gray so i unable to give any data in that field.

1. Create cost elements for Asset Reconciliation account of category "90". Then system will automatically derive cost center from the asset master record.

2. Go to T.code – ACSET – Select company code & double click on Account Assignment Object give company code 1100, Depreiciation Area -01, COD – 1000

3. Account Assignment Object Acct. Asign obj Name Transaction Account Assignment type Account Asstn

KOSTL Cost Center * 01 APC Value Posting X

KOSTL Cost Center * 02 Depreciation Posting X

4. Go to T.Code – OME9 – select “A” tick mark on “Derive Account Assignmet”

5. OBC4-Keep cost Center & Profit Center optional Field in FSG -G067

Issue No.: 28

SAP Error Massage: AA449, Auxiliary account assignment to asset not possible, remove entry

While post Asset Sale, it is giving me following error: Auxiliary account assignment to asset not possible, remove entry Message no. AA449. In F-90 with transaction type 200 & 210.

Solution:

1. Go to T.code OBC4 – select Field Status Group – G067 & G008. Make sure profit Center field & Cost Center field are optional entry in Dependent tab & Asset accounting tab with all optional Entry & same with consolidation tab.

Issue No.: 29

SAP Error Massage: AA449, Auxiliary account assignment to asset not possible, remove entry

Error Occerance :

Solution:

1. Go to T.code OBC4 – select Field Status Group – G067 & G008. Make sure profit Center field & Cost Center field are optional entry in Dependent tab & Asset accounting tab with all optional Entry & same with consolidation tab.

Issue No.: 29

How to view day wise Depreciation Report

Solution:

Solution:

Go to T code AFAMA - select Day to the day check box And period control according to the fical years

Then Go to AW01N

Issues No.:30

Requirement:

Then Go to AW01N

Issues No.:30

Requirement:

The user has wrongly posted Extra amount on Asset APC value & charged same amount of unplanned deprecation in previous year (2010), which has been closed now as result system calculate deprecation on actual APC+ Extra amount on next year. But at 2011 user wanted to Reverse the acquisition value (Negative Impact) & reverse the unplanned deprecation (Positive Impact) which were posted in previous year.

1. Customization Changes:

To increase of Acquisition value in 2011 or Positive impact of Accumulated deprecation of 2010 of asset.

1. Customization Changes:

To increase of Acquisition value in 2011 or Positive impact of Accumulated deprecation of 2010 of asset.

Create New Transaction Type Z64 copy from Transaction type 640 t. code A078. There you should tick mark on “Debit transaction” keep remain same & save it

2. Pass JV by t.code to reduce the aqusiton value in next fiscal year e.g 2011 by t.code

Depreciation expenses (entry should be pass on first date of fiscal year example 01.04.2011)

To Asset account a/c with transaction type 103

3. Pass unplanned deprecation to get Positive impact for unplanned depreciation by t.code ABAA.

In ABAA- Keep posting date first date of fiscal year & transction type Z64 & Save.

4. Asset explore by t.code AW01N for impact in asset accounting But financial impact will happen once depreciation is posted by t.code AFAB.

Issue No - 31

SAP-Error Message AA662

SYST: You cannot change the depreciation periods massage No. Message no. AA662

Error Occaracne:

depreciation keys according to monthly calculation of depreciation but after posting depreciation for 3-4 months through AFAB in Production system Client requires it to be changed to Daily Basis calculation of Depreciation.

As Result Conflict in TABLE- T090-XDAILY = X (day wise depreciation) But in Table ANLB-PERFY= 12 (It should 365 after change) , for Existing asset only.

Solution:

1) in the depr.key: T090NA-XDAILY = X

2) in the asset: ANLB-PERFY = 365 (

ANLB-PERFY = 365 and T090NA-XDAILY = X => correct

ANLB-PERFY = 12 and T090NA-XDAILY = initial => correct

Go to Se16n

Depreciation expenses (entry should be pass on first date of fiscal year example 01.04.2011)

To Asset account a/c with transaction type 103

3. Pass unplanned deprecation to get Positive impact for unplanned depreciation by t.code ABAA.

In ABAA- Keep posting date first date of fiscal year & transction type Z64 & Save.

4. Asset explore by t.code AW01N for impact in asset accounting But financial impact will happen once depreciation is posted by t.code AFAB.

Issue No - 31

SAP-Error Message AA662

SYST: You cannot change the depreciation periods massage No. Message no. AA662

Error Occaracne:

depreciation keys according to monthly calculation of depreciation but after posting depreciation for 3-4 months through AFAB in Production system Client requires it to be changed to Daily Basis calculation of Depreciation.

As Result Conflict in TABLE- T090-XDAILY = X (day wise depreciation) But in Table ANLB-PERFY= 12 (It should 365 after change) , for Existing asset only.

Solution:

1) in the depr.key: T090NA-XDAILY = X

2) in the asset: ANLB-PERFY = 365 (

ANLB-PERFY = 365 and T090NA-XDAILY = X => correct

ANLB-PERFY = 12 and T090NA-XDAILY = initial => correct

Go to Se16n

Give table ANLB & Put Company code , asset number having error. & put Command "&sap_edit" in command field. Excute it appears table edit activated. Get Inside & change manually the field PERFY=365, do save.